Liability

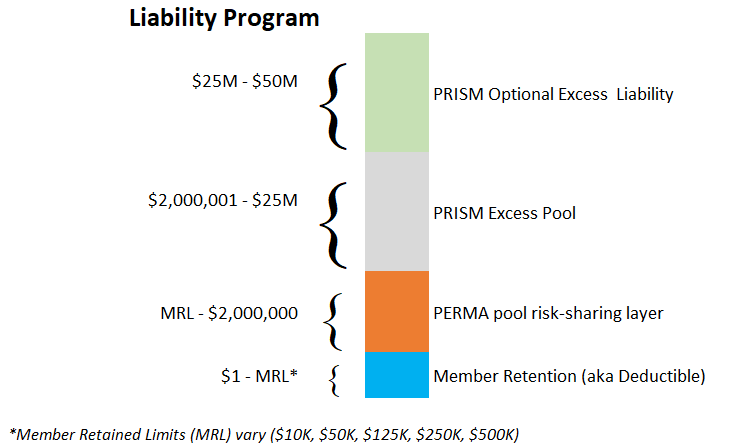

The Liability program provides defense and indemnity coverage against claims and suits arising from covered occurrences. Members select a member retention level (MRL) and jointly fund losses above the members’ retentions up to $2,000,000. PERMA is a member of the Public Risk Innovation Solutions and Management (PRISM) for excess liability coverage. PERMA has a $2 million retention and PRISM provides coverage from $2 million to $50 million.

Program Highlights

In late fall of 2025, PERMA began handling liability claims with in-house staff and transitioned its claims data to Origami. PERMA believes well-trained and experienced in-house claim staff ensures timely responses to the members as well as more effective and efficient claim resolutions. Please see the "Adjuster Assignments - Liability Program" document in the sidebar for a list of adjuster assignments by member agency.

Crisis Incident Management & Communication Services

Crisis Management Services (both pre- and post-incident) are provided to assist with situation assessment, media consulting, press releases, and deployment of outside resources to member sites. The services are provided to member upon pre-approval by PRISM, and paid for by PRISM, up to $50,000 per incident. Costs above that are paid by the member. If you have a crisis, contact PRISM at (916) 850-7700 to authorize services.

Auto Liability Cards

State law requires evidence of financial responsibility be carried at all times in all vehicles. Vehicle Code section 16020(b)(4) states that “Evidence of financial responsibility” means “A showing that the vehicle is owned or leased by, or under the direction of, the United States or any public entity, as defined in section 811.2 of the Government Code.”

In other words, for a public entity, the vehicle registration should be sufficient to meet the requirement of evidence of financial responsibility.

Members should consider placing a copy of the current Automobile Liability Card (which includes the applicable Vehicle Code) in the vehicle with the registration. See the right sidebar “Auto Liability Card” for the current fiscal year’s cards.

Vehicle Accident Kit

The following items are suggested to be carried in your vehicle glove box to help in the event you are involved in an accident:

- Pencils or pens

- Note pad

- Camera (disposable; although most employees have mobile phones which can be used instead)

- Tape measure

- Vehicle registration

- Personal Auto Accident Kit

- Automobile Liability Coverage Card (documents found in the sidebar)

Other information you may want to consider carrying in the glove box:

Declarations of Liability Coverage

In the past, the “Declarations of Coverage” documents were posted on the PERMA website and emailed to the members.

Beginning with the 2022-23 Program Year, the information has been integrated into the Memorandum of Coverage (MOC; see link in sidebar) document and thus will no longer be provided separately. Please see pages 2 (Declarations) and 3 (Schedule of Covered Members which includes retentions).

The Declarations of Coverage previously listed a variety of member departments, commissions, or boards. These entities are covered as long as they are part of the city and/or meet the definition of “Covered Parties” in Section II – Definitions on pages 4-5 of the MOC.

If your agency receives a request from a third party to provide proof of coverage, you can provide the MOC as proof. If the agency will not accept the MOC (e.g. it requested to be named as an “Additional Covered Party” (aka additional insured)), please request a “Certificate of Insurance” from PERMA’s website.

Medicare Reporting Compliance

Medicare is the nation’s health insurance program for individuals who are age 65 or older and individuals with certain disabilities. Medicare is funded by the taxpayers. Under Medicare Secondary Payer (MSP), if Medicare makes payments on an injured party’s behalf when the treatment should have been covered by the tortfeasor (in this case, the PERMA member), then the Medicare payment is deemed “conditional” and Medicare is entitled to reimbursement. In other words, if a third party is injured, files a claim against the public agency, and the claim settlement includes payment for bodily injury, the public agency is responsible for reporting those payments to Medicare.

As the member’s third-party claim administrator, PERMA has the responsibility of timely and accurate reporting all injury claimants to the Centers for Medicare & Medicaid Services (CMS). CMS coordinates Medicare benefits as well as recovery of conditional payments. Diligent efforts must be made, and documented, by PERMA staff to report all claims which may involve Medicare. Failure to do so results in monetary penalties as the conditional payment obligation is required under law. Improper reporting may also result in civil monetary penalties of up to $1,000/day of noncompliance with respect to each claimant.

To ensure proper reporting is made, a revised blank Government Claim for Damages (liability claim form in the sidebar) has been created for member use. Each member agency is requested to utilize the template (please first customize it with information specific to your agency) which collects the mandatory information required by Medicare. Note: personal identifiable information has been added to the form such as date of birth, social security number, email address, and a box for Yes/No to indicate if claimant is a Medicare/Medicaid/Medi-Cal receipt. If a public record act request is received for a claim form, this information should be redacted.

Members are also reminded that all liability program claims, and corresponding back-up, should be submitted electronically to claims@permarisk.gov email box to ensure proper processing. If the file size is too large to send through email, a link to a share file will be provided so the document(s) can be uploaded.

Registry of Public Agencies

California law requires certain public entities file certain information with the Secretary of State and the county clerk of each county in which the public agency maintains an office. Government Code § 53051 requires the disclosure of the information on Form 405, “Registry of Public Agencies.” The law also provides that a public agency must file an amended statement within 10 days after any change in the facts reported in the original Form SF-405. This requirement must be met any time there is a change in the names or reported addresses of the members of the governing body or leadership of the agency. The statement of information overview contains more detailed information. If your public agency has not filed the requisite Statement, please ensure it does so without further delay. This requirement also extends to any other public agency, successor agency, JPA, special district, etc., your agency has created or is part of.