Auto Physical Damage

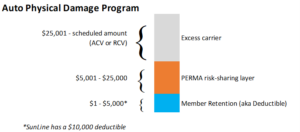

PERMA group purchases commercial insurance for auto physical damage for vehicles. The 2022/23 program includes a $10,000,000 limit, a $25,000 pool deductible (inclusive of member deductible), and a member deductible of $5,000 (Sunline has a $10,000 deductible). See program documents for full details.

If you have questions contact PERMA at info@permarisk.gov

Online Vehicle Schedule Updates

While it is best practices to add vehicles to the schedule upon purchase, the excess carrier’s (Hanover) policy contains a provision wherein there is coverage for vehicles valued under $1M if the member purchased it during the policy period but then neglected to add it to the schedule. If there is a vehicle loss of a vehicle purchased in a previous policy year, and it was not scheduled, there is no coverage. Vehicles with values over $1M must be scheduled within five (5) days of acquisition.

Members can make updates to their vehicle schedules by logging into the Alliant Portal. The following link will take you to the site, InsureID. Login information was sent to each member. Once logged in you can view your agency’s vehicle schedule and make changes as needed. If a staff member at your agency needs access to make updates, please contact PERMA to have them added to the system.

Remember – your agency’s coverage and premium is determined by what you schedule.

- Buy something? Ensure it is listed so your agency has coverage.

- Sell something? Remove it from the schedule so your agency isn’t paying unnecessary premium.

As a best practice, vehicles should be scheduled upon acquisition. Vehicles valued over $1 million MUST be scheduled within five (5) days of acquisition.

The auto physical damage policy contains an endorsement which allows members – if they choose – to schedule vehicles using replacement cost (the amount it would cost to replace the vehicle), instead of using the actual cash value (aka Kelly Blue Book or depreciated value). If you need help determining appropriate values, the “vehicle valuation form” prepared by Alliant provides suggestive average vehicle values. Please take into account your agency’s specific circumstances when scheduling the values.

Important update regarding contractor and mobile equipment:

Please note contractor and mobile equipment should be scheduled under the property program, unless it is licensed for road use. If the equipment is subject to vehicle registration based upon the California Vehicle Code (i.e. licensed for road use), then it should be scheduled on your agency’s vehicle schedule.

- While your agency can use one line item to list the value of contractor’s equipment or mobile equipment that is contained on one site, staff recommends you list the items individually on your schedule to ensure the values are appropriate and there are no coverage issues.

There is a distinction between mobile equipment vs. contractor’s equipment.

- Contractor’s equipment is only used for building/construction, while mobile equipment does not apply to those functions (i.e. a projector can be considered mobile equipment while it wouldn’t be considered contractor’s equipment).

- Note: heavy equipment is a subset of contractor’s equipment. Again, if the heavy equipment does not have motor vehicle registration, then it would be reported on the property schedule.

Tutorials are located at the links below along with a training video. If you encounter issues, or would like additional training, please contact Katie Achterberg. PERMA members are asked to make schedule updates throughout the year, as property and vehicles change, to ensure the annual renewal submissions are accurate.

Vehicle Accident Kit

The following items are suggested to be carried in your vehicle glove box to help in the event you are involved in an accident:

- Pencils or pens

- Note pad

- Camera (disposable; although most employees have mobile phones which can be used instead)

- Tape measure

- Vehicle registration

- What to Do in Case of Accident

- Accident Checklist

- Vehicle Accident Report

- Witness Information Card

- Automobile Liability Coverage Card (documents found in the sidebar)

Other information you may want to consider carrying in the glove box:

Auto Liability Cards

State law requires evidence of financial responsibility be carried at all times in all vehicles. Vehicle Code section 16020(b)(4) states that “Evidence of financial responsibility” means “A showing that the vehicle is owned or leased by, or under the direction of, the United States or any public entity, as defined in section 811.2 of the Government Code.”

In other words, for a public entity, the vehicle registration should be sufficient to meet the requirement of evidence of financial responsibility.

Members should consider placing a copy of the current Automobile Liability Card (which includes the applicable Vehicle Code) in the vehicle with the registration. See the right sidebar “Auto Liability Card” on the Liability page for the current fiscal year’s card.

Report a Loss

AdminSure has been contracted to provide auto physical damage claim handling services for PERMA members. Members are responsible for the following:

- Timely and accurate claim reporting. Claims reported to PERMA within thirty (30) working days will be considered timely.

- Reporting the loss, using the Loss Notification Form, as soon as possible. If available, please include the following information for the claim file:

- Location of the vehicle

- Status (still operable or not)

- Available photos

- Member agency-generated incident reports

- Do not wait for a police report, repair estimate, or other documentation.

- The police report, preliminary repair estimate, etc. should be forwarded for the claim file when available

- All claims must be reported, including claims with a value anticipated to be below the member deductible.

AdminSure will report losses to PERMA’s carrier as necessary.